Challenges and opportunities: what are the new prospects for the market?

Published on 6 November 2023

Maison&Objet Barometer #7. Every 6 months, Maison&Objet delivers a “weather report” on the conditions in our industry. After successive storms and unsettled conditions that are still underway, the industry is getting back to a more stable pattern that’s ushering in new opportunities. These include the promising wellness market, which our new survey has put under the microscope.

The state of affairs: troubles affecting the entire industry

Out of the 1,133 international professionals who replied to our questionnaire throughout October, more than two-thirds of them stated that their sales have remained stable or have increased over the past four months. This is particularly the case for specifiers. 75% of them said that their numbers are up compared to the previous barometer. This result is even more remarkable if you consider the challenges faced by decorators, architects, and space planners. A French survey of building contractors in early 2023 (1) estimated that the price of materials increased by 27% year-on-year.

Retailers and brands have been similarly affected by these increases, which are impacting both margins and sales. COVID, the war in Ukraine, Brexit (for some), and especially inflation – which the Maison&Objet barometer in February 2022 had already measured the considerable impacts of on all types of businesses in the industry (2)…This state of the industry confirms that these problems remain omnipresent.

“Many products are now above our clients’ psychological price threshold. The average purchase price of 45 € - 120 € has undergone a significant drop”, according to a retailer from Eastern France. “Today, the income threshold we’re targeting has moved upmarket…We’re now targeting clients with an increasingly higher income level”, says an interior design professional. “The cost of living is squeezing the middle of the market out of luxury craft”, adds the agent for a British brand.

it’s important to add other indicators that underline their resilience to the stability or even increase in sales figures highlighted by industry stakeholders. Whereas pessimism was the rule at the end of 2022, prospects for the next 4 months are looking up for 37% of professionals surveyed. Therefore, this new edition of our survey confirms a relative recovery that the April 2023 barometer hinted at. On the Retail side, 33% of French respondents are optimistic, whereas this proportion goes up to 52% of international retailers. For Specifiers, this geographic disparity is also notable: 29% of French specifiers feel optimistic, whereas 51% of international ones do. And finally, in terms of Brands, 87% of them plan to launch new products within the next 4 months and are showing stable inventory levels.

THE DIGITAL STAKES

Beyond the numbers, the barometer offers the chance for respondents to express themselves more broadly in terms of how they feel about the market, on both specific issues and on solutions that each professional may develop. Matters raised by professionals included online sales channels. Though the transition to digital has been a given for quite a while now, critical voices are emerging, echoing those that have made the international news of late. We can note, specifically, the case filed by the American competition authorities against Amazon, which accuses the platform of making merchants’ eligibility for “Prime” conditional on the use of their “costly” logistical services. It’s also about Facebook or Instagram’s modification of their rules or algorithms, which seem to leave less space for smaller stakeholders to stand out and are impacting their business.

“The Google search rankings in place since 2015 widely favor large companies”, notes the agent for a Belgian brand of children’s furniture. “Facebook sometimes makes crazy decisions like closing your account”, says the owner of a Lithuanian e-commerce website. "Amazon in an unfair competitor…They use monopolistic practices while putting pressure on their suppliers to get the best prices. When will we have some European regulation on this?”, complains a Spanish buyer. Many are calling for greater legislation and regulation, notably of repeat discount offers online.

Our industry is also understandably raising questions about AI and its impact on all our professions. “We are very interested in expanding our marketing activity by making use of AI in support of all our communication. The continued demand to create outstanding content is an ever-present must for a digitally focused business”, a lighting brand based in the UK has stated. On the design side, caution is the order of the day: “Chances are that we’re moving toward design generated by algorithms and, thus, toward a drastic depletion of what makes humans unique, in other words, our capacity to create”, worries the founder of a Parisian architectural firm.

Though the contradictions inherent in the digital sphere are highlighted, this essential medium of communication also offers an incomparable way to proudly proclaim and publicize one’s distinctiveness, at a time when clients are examining how they consume. To date, 35% of brands surveyed state that they rely on listing platforms or B-to-B marketplaces. It is with this desire to support industry stakeholders in mind that Maison&Objet is developing new digital tools to drive professionals' growth, notably, the MOM marketplace, which guarantees high product and visitor quality, reflecting its expertise.

THE NEED TO EDUCATE CONSUMERS

“We need to educate the consumer more and more about the real cost of things, whether it’s the cost of labor or quality”, states an interior design professional. “The market is saturated with offers, some of which are at discounted prices, but the client has trouble understanding the difference”, adds an interior designer.

Inflation isn’t helping tip the scales in favor of quality or sustainability and is sharpening the dilemma for the client who was often cited in our previous barometers.

“It’s always an ethical debate when artisans creating an original product, supporting an authentic upliftment project, and using expensive materials to ensure a high-quality product, get copied by mass producers and then flood the market with cheap copies. How do we protect the artisan, and how do we educate the consumer? This is a specific challenge that we find ourselves in”, emphasizes a South African brand. One respondent suggested including a “score” for products. “That’s what will make the difference against these ‘neo-bazaars’ that are mainly based on price. Without some sort of commitment, justifying a higher price is meaningless”, he argues.

STANDING OUT FROM THE CROWD THROUGH EXPERIENCE

Whether it’s about making a name for yourself, attracting new customers, or transforming a visit into a purchase, the solutions highlighted in the survey focus on differentiation. “The art of the matter now consists of reaching out to the client using all their senses and offering personalized advice”, recommends a Munich-based product designer. “You have to build stories around each product, create events, invitations, culinary demonstrations…Customers appreciate this type of special relationship”, ensures a Swiss retailer. This type of differentiation can happen via a selection of more unique products. “I’m always looking for high-quality, original French or European brands that you can’t find online”, an independent retailer told us. “Spend time with your clients, and they’ll give it back to you tenfold with their loyalty. Each client needs to be acknowledged, and then, local boutiques will have a bright future”, claims the manager of a family-owned perfumery that has done business this way…for a century.

“Well-being is the major trend in our society and industry. We’ve had a wellness department in our store for several years. Nowadays, nearly 15% of our turnover comes from wellness-related items, and the sales of wellness items are still increasing”

NEW MARKETS, NEW CLIENTS

The development of workspaces within residential projects, the shift toward more dynamic international markets, the offering of new coaching services…These options, which were explored and mentioned in the survey by industry stakeholders, are proof of their fighting spirit and capacity to adapt and recover. Among the most promising prospects are those for the wellness market. “Well-being is the major trend in our society and industry. We’ve had a wellness department in our store for several years. Nowadays, nearly 15% of our turnover comes from wellness-related items, and the sales of wellness items are still increasing”. This testimonial is a perfect illustration of the analysis from the American Global Wellness Institute (3), which expects global growth of 9.9 % per year over the next five years for a market that is projected to reach 7 trillion dollars in 2025. “We have to move faster to enter the wellness business and capture the opportunities”, proclaims a product designer from Bangkok.

In its details, the survey shows us that for resellers, the current offer is focused on products that are already very common: fragrances and perfumes, cosmetics, and household cleaning/home care products. These are sold by 75% of retailers. “Despite higher inflation and lower purchasing power…, prospects remain bright for the fragrance sector – and this, despite an ultra-competitive marketplace – for high-quality products that stand out from the competition (in terms of their packaging, content, product universe, etc.), and even more so for gift items”, a French brand even asserts.

With a quarter of respondents highlighting them within their retail spaces, holistic and food products, sports accessories, and more are shaping this much broader vision of wellness today that is driving this expansion of the market.

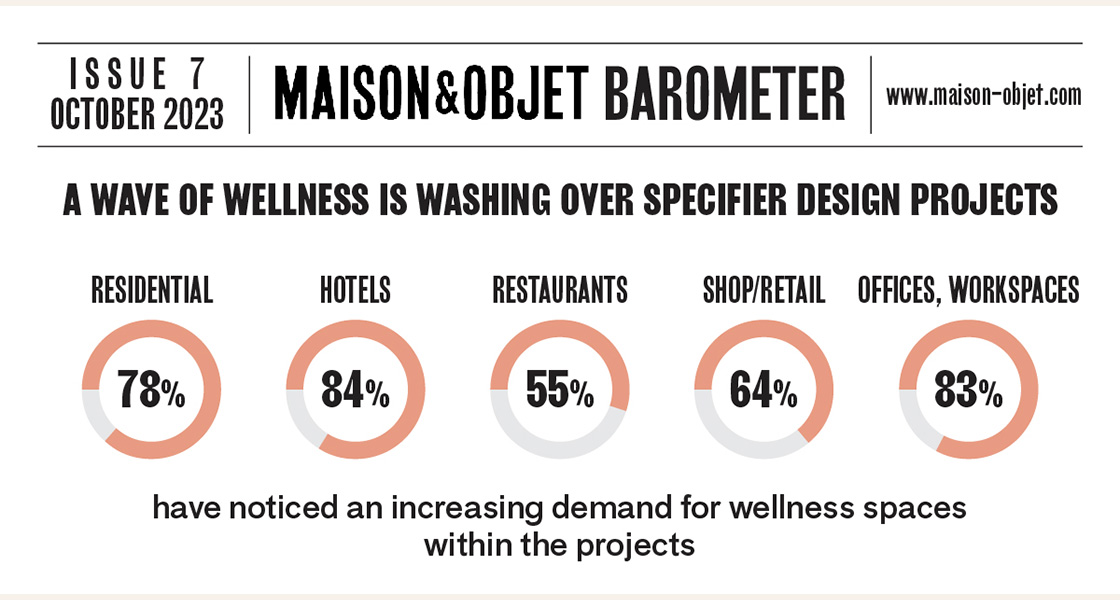

This trend has already been widely adopted by specifiers, 78% of whom are seeing increasing demand for wellness spaces. 84% of them have noticed this same desire within their hotel projects, 55% within restaurant projects, and 64% within boutique and retail design projects. Even more astonishing is the fact that 75% of specifiers state that they are involved in the acoustic ambiance of spaces, and 69% in setting the olfactory mood. Such intangible needs demonstrate a truly real desire for well-being. Understanding and meeting this new need is the entire raison d’être of the new WELL-BEING & BEAUTY sector launched in September at the Maison&Objet Paris fair. This sector, which will be making another appearance in January, will transport visitors into a specially dedicated space that will host immersive experiences, making it a place to discover all the aspects of an offer that aims to bring softness to our everyday lives. How could you possibly resist?

MORE IN-DEPTH INVESTIGATIONS:

Wellness experiences: a thriving business

This new Maison&Objet barometer is a feast for all the senses: sensory-based offerings are the word of the day in the retail world, and wellness spaces are making inroads within architectural projects.

The survey shows that well-being is ultimately about living well. And what do the experts, those who have made this their specialty, say?

Duration: 27 minutes

Watch the episode