The return to localism: where do we stand?

Published on 1 July 2022

Maison&Objet Barometer #4. 88% of respondents have confirmed it: clients are increasingly scrutinizing product origin and raw materials used to make them. Can this now-widespread demand be satisfied? The survey highlights our industry’s ambitions and limitations and debunks a few preconceived notions.

For its barometer, Maison&Objet surveys industry stakeholders three times a year on market indicators or subjects of current interest. This data is based on the results of an online questionnaire conducted from May 30th to June 10th, 2022 of 730 Brands, Retailers, or Specifiers.

For 60% of all respondents, this client demand is being expressed even more fervently than before the shipping and inflation crises. At the forefront, dealing with consumers, are the buyers, in other words, the retailers and specifiers who are echoing this trend - 62% of them, compared to 53% of brands.

The state of play

This new edition of the barometer brings to light practices and manufacturing that, contrary to a common misconception, are already largely locally rooted. 80% of brands surveyed say that they already source raw materials on their own continent, with 27% completing their sourcing using materials from other parts of the world. 83% of them manufacture all or part of their collection and product ranges within their own continent.

Those who do so have often been investing in this approach for quite some time, either due to tradition or by necessity, without publicizing it. “For nearly 30 years, we’ve always kept producing and having our products produced locally “, Egmont Toys have pointed out. “50% of our output is made in Europe “, specifies this Belgian brand, while French brand Filt can claim exclusively French production of their mesh shopping bags since 1860!

On the buyer side, 90% state that they source finished products within their own continent, with half of them also filling in inventory from outside this zone.

Overall, 52% of professionals surveyed confirm that at least part of their production or sourcing is already localized.

A trend that is being confirmed

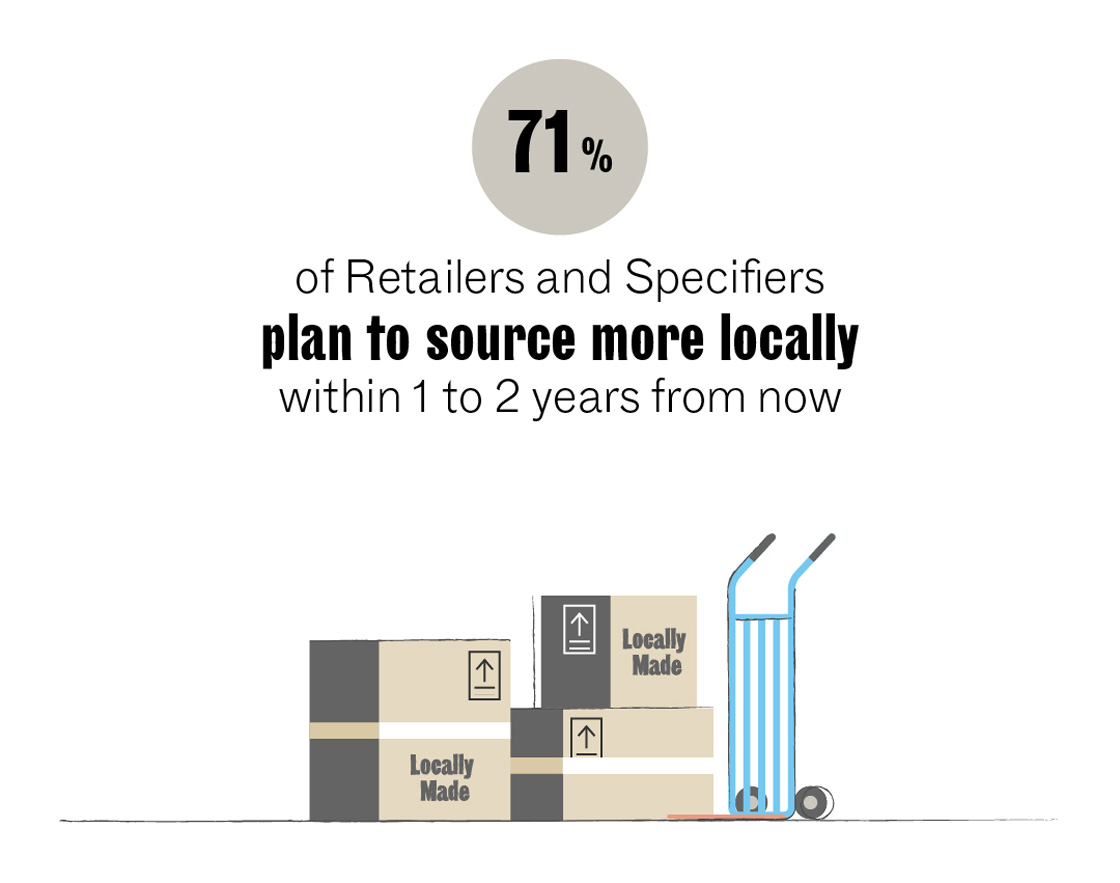

One-third of retailers and specifiers state that they are ready to undertake a “reshoring” process. 71% of them are even planning to make this shift a reality within 1 or 2 years, at the most. Many factors have gone into this decision, such as those mentioned by QE Home, a Canadian concept store that highlights ethical manufacturing criteria within their assortment, and notes that “China's zero Covid policy is also delaying product delivery times”. “It’s important to reshore and focus on quality, not price. If the sales pitch is solid and coherent, sales will follow because clients (…) know what’s going on”, states the manager of a French boutique.

For nearly half of buyers and brands that have begun or plan to bring back or reshore their production or sourcing to their home turf, the goal is to refocus on their own country, or even, for 23% of them, to operate on a more regional level. And lastly, 29% of them plan to do this type of rebalancing within their own continent. In Europe, three countries are benefiting from particular interest from brands: Portugal, Italy, and Spain.

These reshoring strategies are far from being dictated only by consumers’ desires. Business continuity, fluidity, and the securing of supply appear to be the major issues that have been intensified by current international events. “First of all, we’re diversifying in France. We don’t plan to give up our plans in Africa”, explains French firm As‘art. “Nevertheless, in Africa, we’re recentering our development on the products and workshops that are the least sensitive to disruptions of all kinds (political, climatic, logistical, etc.)”. For Belgian brand Chehoma, “many stakeholders wanted to reshore to Eastern Europe, but the Ukrainian crisis showed us that this wasn’t the only solution. Multi-zone sourcing remains the most viable solution, from our perspective”.

The obstacles to reshoring

The fact remains that 22% of professionals surveyed don’t currently plan to reshore their supply, whether in terms of raw materials or finished products. Some of them say that their business is based on products and expert skills that are only available in certain countries. “We have important long-term business relations in India, there are no factories in Europe that can make what we need for the same price or quality “, says an English brand that is not the only one to attest to long-term relationships and fruitful partnerships that are sometimes an essential part of the company’s identity. “Most of our products are culturally based or are curiosities that can only be found in Asia and South America. We prefer to focus on this unique aspect”, explains French boutique Brin De Causette, which nevertheless specifies that they have started working with local artisans over the past 2 years.

The hesitancies of industry stakeholders often stem from major financial constraints.” Cost, as our products are relatively labour intensive and energy cost are high in Europe for metal product manufacturing”, are the main obstacles mentioned by a German brand.

This is a very common finding, since 70% of brands blame higher manufacturing costs and 52% of them, higher purchasing costs.

For 41% of brands, the complexity of finding new suppliers is being added to these obstacles. “Many workshops have gone out of business. For some products, it has become very difficult or even impossible to manufacture locally, first, because the raw materials are no longer available (…) and because we no longer have the tools and skills on hand “, Egmont Toys explains. “Certain expert skills have disappeared in our country “, adds Email Replica. “Even for basic materials, we often have to look abroad “, this French brand says with regret, while a retail chain is calling for the “reindustrialization” of Europe and declares that they are having problems sourcing textiles, tableware items, and furniture in Old Europe. Electrical components, copper…While 44% of brands emphasize the lack or even non-existence of raw and other materials in certain zones and the necessity to source from faraway countries, on the other end of the chain, in Europe, some are reflecting fears in their comments about delivery delays caused by local production channels’ lack of capacity.

“Many workshops have gone out of business. For some products, it has become very difficult or even impossible to manufacture locally, first, because the raw materials are no longer available (…) and because we no longer have the tools and skills on hand”

To the difficulties of finding new suppliers, which is even more pressing for buyers (56%), we can add the fear that, for 44% of them, they will have to work with a smaller supplier portfolio. “It's a lot more work to source locally as they tend to have small ranges, so I need to order from more people “, states an Irish retailer. Israeli and English specifiers have expressed their problems sourcing or finding a sufficiently diverse offer in their countries, while international sourcing also allows them to stand out by offering something more unique.

Brand image and credibility

For many, reshoring offers the chance to make a concrete, positive impact on company operations. Four out of ten participants in the survey, for example, hope to benefit from shorter shipping times.

It’s especially in terms of the image projected to the client, traceability, better quality, and, thus, credibility, that the desirable consequences of reshoring can be seen. For 71% of brands, it’s about lessening their environmental impact, and for 58% of them, a return to socially-oriented values. For 53% of them, reshoring could have a beneficial effect on their brand image. On the buyer side, 48% of them hope for better quality, and 39% expect improved product expertise.

Such are the many improvements that may satisfy the new type of client, who is certainly demanding, but not always ready, as some say, to pay more for products that are nevertheless more suited to their expectations. “The most challenging aspect is that consumers would like to have a local product made under ethical and environmentally conscious working conditions, but at the same price as that of the ‘Chinese’ product”, observes Egmont Toys. “We are working and living in a new age of extremes”, summarizes Hans van den Hout, CEO of Dutch firm RetailLAB. “Prices rise sky high and customer's demands are sometimes insane (24 hours deliveries). But we think and feel that premium design and high-quality products will survive as long as the story behind the product or company is clear, understood and expected by the ultimate customer”. If they want to behave in accordance with their beliefs, consumers must also be ready to make an effort.

Discover the infographic, which reflects the major indicators of the Barometer.

MORE IN-DEPTH INVESTIGATIONS:

The Shift towards Local Sourcing in a Post-Covid World

Maison&Objet Academy helps you understand the market and trends and how to make the right choices for your business.

In the face of raw-material and energy price inflation, everyone has their own strategy. Brands, retailers and specifiers have learned to play around with the numbers, but most find themselves forced to pass on price increases, at least partially.

Available by subscription with a 7-day free trial

or by rental 7,49 € excl. VAT

Duration: 35 minutes