After resilience, optimism is in sight

Published on 14 November 2024

Maison&Objet Barometer #9. Six months after the last check-up, Maison&Objet once again examines the decor, design, and lifestyle industry with a complete assessment of the field, thanks to the participation of nearly a thousand retailers, specifiers, and brands. Here’s an overview of it all.

For the 2nd barometer of the year, in October, Maison&Objet collected the views of industry professionals on the current business climate and their prospects. Overall, the situation is complex for market players.

36% of professionals surveyed were disappointed to have experienced lower sales volume over this period. Such was the case specifically for 40% of retailers.

36% percent of respondents stated that their sales had stayed even between April and September 2024, including 42% among design project leaders (specifiers).

On the other hand, 29% of respondents were pleased with higher sales over the past six months. This is 4 points higher than in the Spring barometer. This positive trend is particularly notable among brands (35%).

Retailers: a hoped-for and (urgently) awaited improvement

Among retailers (independent boutiques, department stores, and other resellers), those most impacted were the ones running physical retail outlets: 39% saw a drop in sales for this channel. The “drop in foot traffic,” “challenges with customer loyalty” among ever-more fickle consumers, or “fierce competition with e-commerce” were the main obstacles that came through when reviewing their comments.

All of this is happening against a backdrop of inflation, lower purchasing power since the Covid period, and a complex economic and geopolitical environment. The European Central Bank, though it remains prudent, has observed a slowdown in inflation in the Eurozone to 1.8% in September 2024, the lowest rate since April 2021(1). If this proves to be lasting, it could lead to an improvement, notably in the next few weeks, as we approach the year-end festive period. According to a survey from Havas Market and YouGov, the French personal budgets for Christmas gifts this year will be 16% higher than in 2023, reaching 261.40€ (2). In Germany, eBay estimates in their report on 2024 Christmas purchases that budgets will be stable compared to 2023: 49% of German consumers expect to spend just as much, if not more, on gifts. (3)

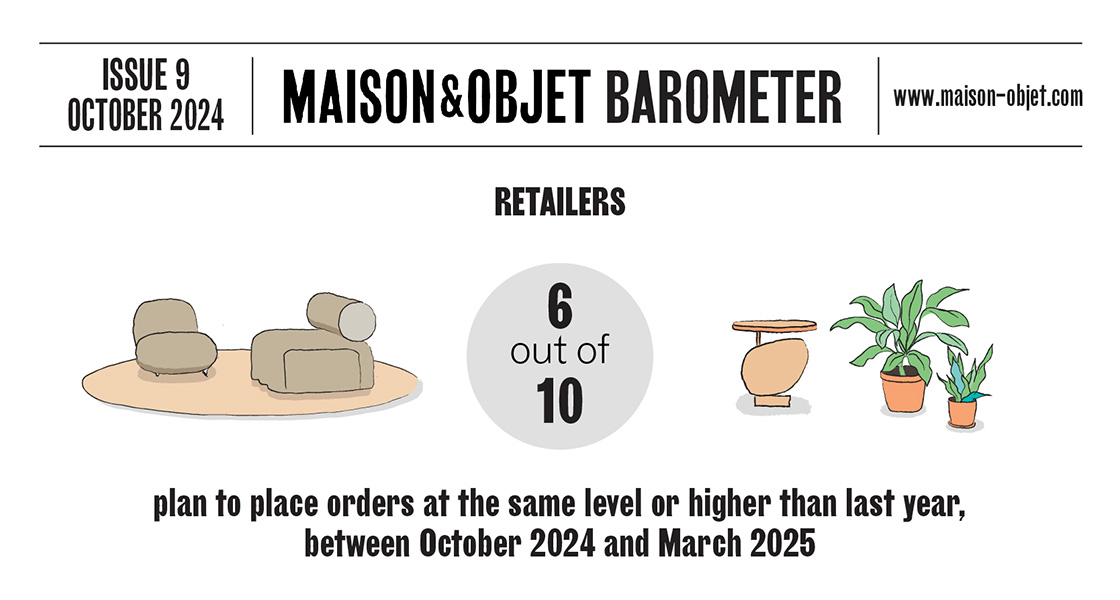

Orders remain stable

As another important and reassuring point, retail is managing to make the most of the current situation. Sixty percent of retailers in the Maison&Objet community tell us that they have managed to maintain or even increase their sales since April 2024, thanks to certain more dynamic product categories. Seven out of 10 retailers who sell fashion accessories, fragrances/scents, wellness products, and gifts have seen an increase in sales volume over the past 6 months, or at least stable sales, compared to the same period last year.

Though 26% of retailers, over all categories, express that they have high inventory levels, these levels are considered stable by 56% of distributors/resellers. This seems to be a sign of their proper management and rotation of assortments, so much so that 95% of retailers plan to place orders from their suppliers from October 2024 through March 2025. Fifty-eight percent of them expect to place orders that are equal to or higher than those placed last year at the same time.

A real-estate sector that’s holding its own…

On the specifier side, five new projects have been signed, on average, between April and September 2024.

Over the past six months, 28% of interior design professionals have stated that the number of projects they’re handling in the residential domain has increased.

This is a situation tempered in France by banking authorities’ tightening of access to credit since 2023, which has led to a drop in residential projects for 39% of French design-project leaders. A slight easing of the situation, fostered by a tentative drop in interest rates, may happen for the French residential market.

“A real softening is expected in late 2025 at the earliest,” says the latest survey from Xerfi dedicated to the French housing market, looking ahead to 2025. (4)

…as is the hospitality sector

Half of specifiers working with the hospitality sector have seen a reduction in the number of projects over the past six months compared to the same period in 2023. At a European level, the hotel business experienced an unprecedented number of bankruptcies last year, in other words, nearly twice as high as the benchmark rate of 2015, according to Statista, the online referencing platform for data from institutes, market surveys, and opinion polls. Nevertheless, investors keep showing confidence in this sector, with hotel-related real estate transaction volume reaching 11.6 billion Euros in the first six months of 2024 in Europe (a 49% year-on-year increase), according to Cushman & Wakefield, a global leader in corporate real estate services. (5)

“Interior designers in 2024 faced a tough time due to economic problems. This led to cautious spending habits among consumers, impacting the demand for services like interior design. We as designers have to adopt more digital tools and software to improve efficiency and enhance client communication, also not forget about human-available-only skills, and constantly improve them.” Comment from Lily Dzis, Interior Designer - Rafael Viñoly Architects, United States

In terms of retail design projects, 48% of specifiers say that they have had a lower number of projects over the past six months. This is undoubtedly tied to the challenges faced by physical retail outlets.

Professionals specializing in office design are seeing a similar drop in business projects (46%). It’s worth noting that since Covid, this sector has made major shifts and is in full reinvention mode. Firms are totally changing how they use space. They are now banking on smaller surface areas that are modular and flexible to better adapt to today’s working environment, which has been shifting over the past four years. Many spaces, particularly vacant ones, will need to be revamped in the future. These have the potential to become new projects for specifiers.

One thing’s for sure: specifiers will continue to walk the aisles of professional trade events. Seventy-eight percent of them have said that trade fairs are their top source of inspiration.

Brands: facing strategic challenges

55% of brands we surveyed have reported stable inventory levels, compared to 60% just a year ago. Over the same period, 21% of them stated that their inventory levels were low, whereas this figure was at 15% in October 2023.

Over the next six months, 84% of responding brands expect to launch new products. This provides some proof of a ceratin optimism despite the current context and multiple challenges they face. “It may be necessary to revamp product ranges to meet new consumer needs, particularly in terms of prices and features. We need to explore innovative solutions and alternative sales models”, in the opinion of a professional based in Latvia.

“The speed at which items are copied is increasing and accelerating with AI. This means that we need constant creativity that’s consistent with the brand’s identity. It also means knowing how to face lower-quality competition that’s very strong in marketing”, states a Spanish brand.

2025: a year for hope?

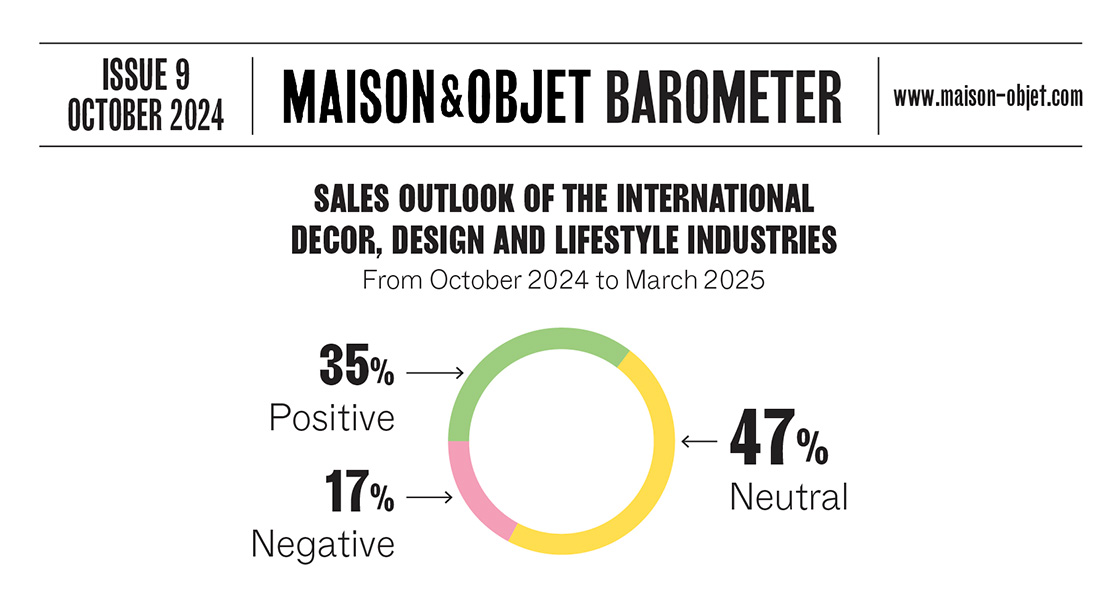

In April’s barometer, Maison&Objet brought to light the great resilience of its community when faced with the multiple crises that have succeeded one another over the past four years. Six months later, this ability of the industry to survive and adapt has now been reaffirmed, while we keep hope alive for the future. Eighty-two percent of professionals from the Maison&Objet community say that their sales prospects are positive or stable for the period from October 2024 through March 2025.