Recycled, upcycled, pre-owned: are we ready for a new lease on life?

Published on 10 May 2023

Maison&Objet Barometer #6. Over 12 years, Maison&Objet’s “green circuit” through the fair, now known as the Sustainable pathway, has been enriched with many brands that reuse discarded materials and waste products, sometimes from our own industry, in increasingly stunning, and even luxurious, ways, as we can see, for example, in the Greenkiss collection by Paolo Castelli or the Arca sideboard from Noma Éditions.

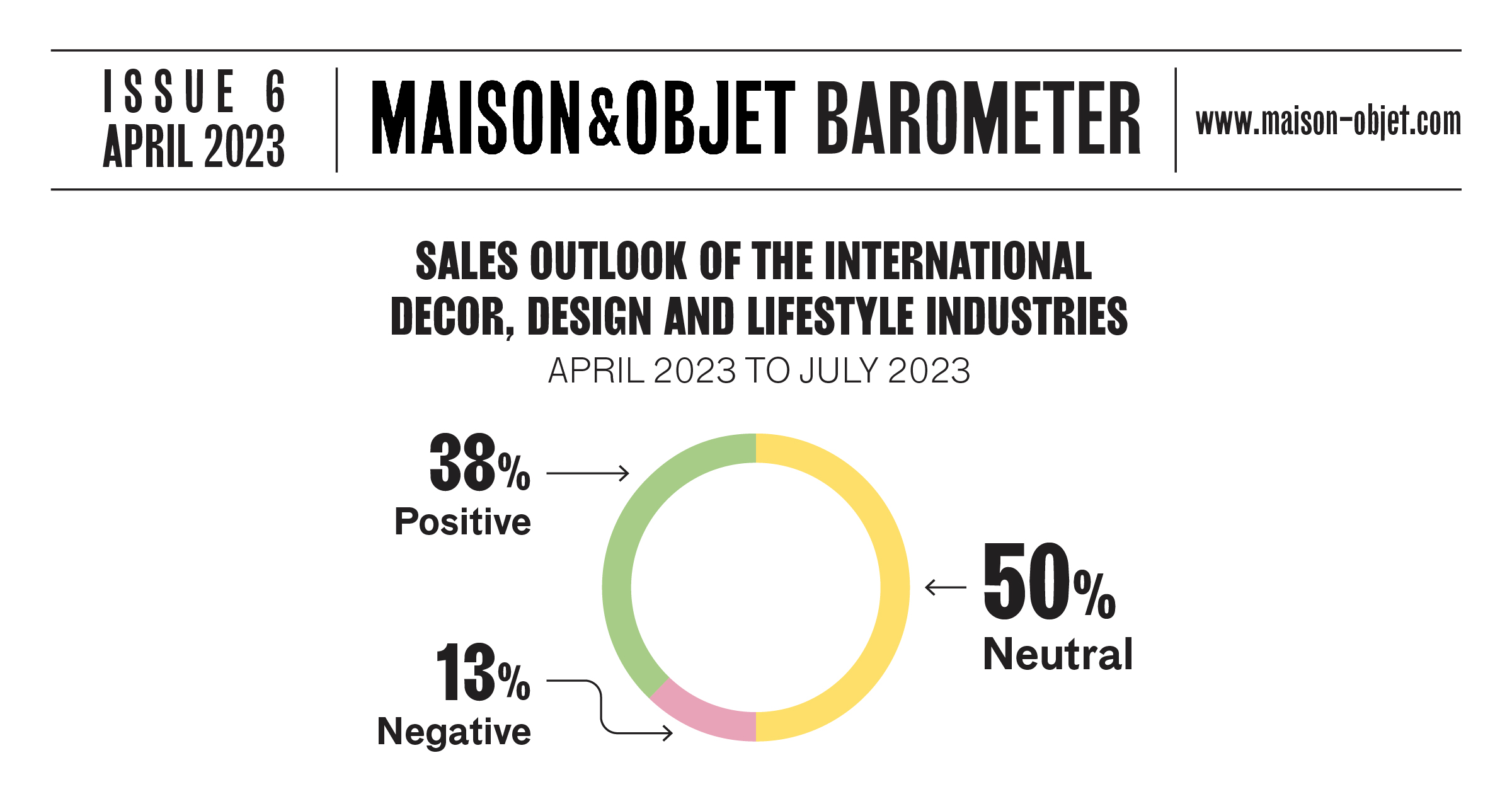

On the occasion of its barometer, Maison&Objet surveys stakeholders from the worlds of decor, design, and lifestyle twice a year about the health of the market and a theme of current interest. 1,207 brands, retailers, specifiers, and hospitality professionals replied to our online questionnaire in April 2023. Whereas in the final quarter of 2022, 34% of professionals who had participated in this recurring survey had negative expectations for the near future in terms of sales, such is the case for only 13% of them in the first quarter of 2023, and 38% even feel positive about the April-July 2023 period to come.

This renewed optimism is the first important piece of news from this 6th edition of the barometer, which will once again provide an edifying insight into a matter of current interest: the growth of the second-hand product market and its inclusion in the life of our professions.

ARE WE READY FOR A NEW LEASE ON LIFE?

In 2025, the global market for used furniture may reach 47.5 billion dollars*.

Retailers such as French brand RBC or pure player Made in Design have launched their own outlet platforms to sell their display furniture, returned items, and unsold merchandise.

In decor shops, it’s no longer unusual to see new and flea-market objects side-by-side.

As for the Ligne Roset brand, it is now reclaiming and restoring second-hand versions of its eternal Togo sofa, which it is then putting back up for sale.

These examples appear to express a certain inevitable movement toward the second-hand market.

Both recycling and upcycling, which consists of reusing parts of an item, sometimes for an alternate purpose, or to update its style, have become routine terms in the world of home design and decor. Still, are industry stakeholders ready for these new habits, or do they even want to adopt them? This is the subject of the latest Maison&Objet barometer.

GROWING DEMAND

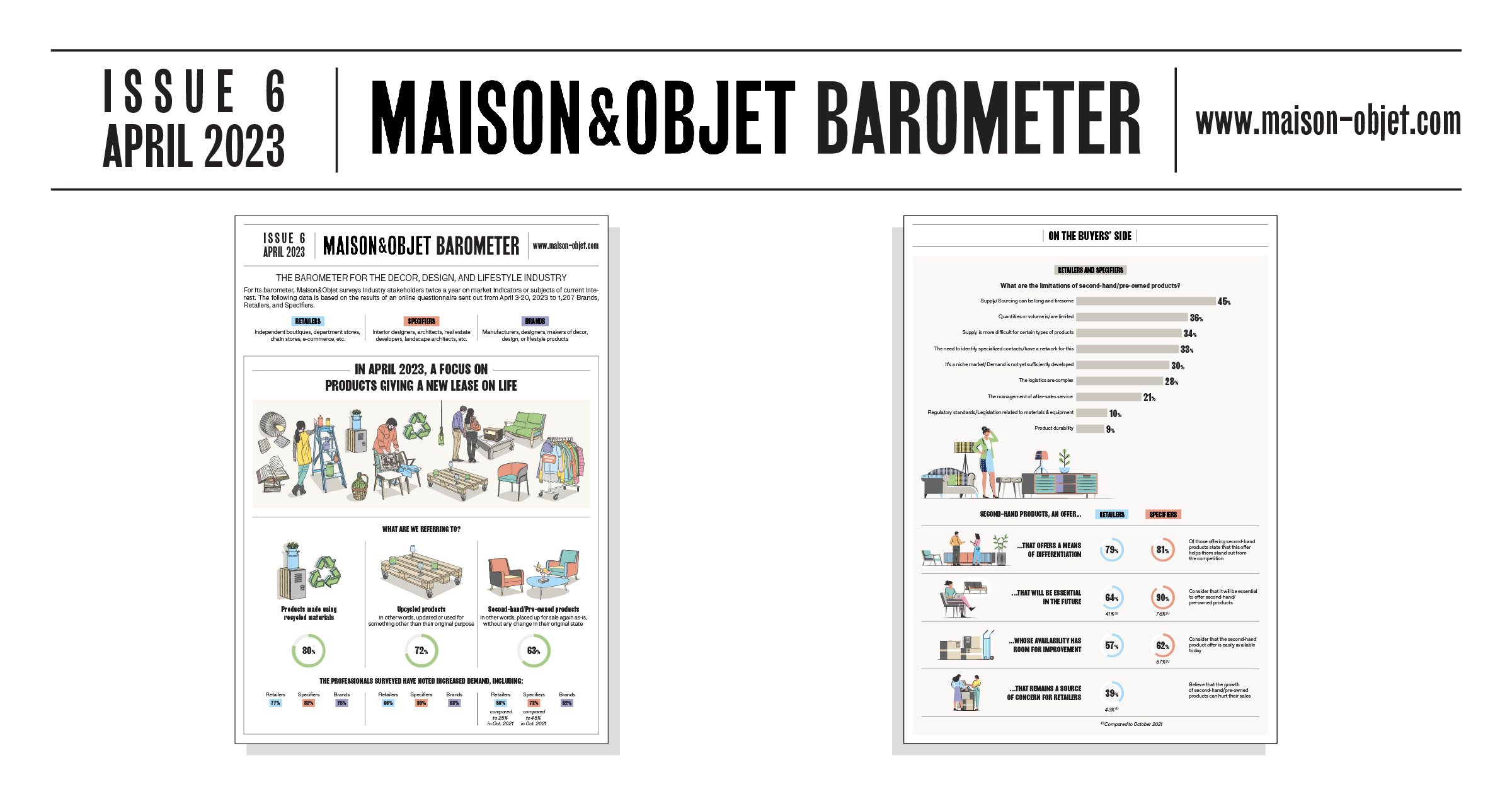

Retailers, specifiers, and brands, get ready: there is now officially a demand for these products. 80% of professionals have noticed a growing interest from their clients in recycled products, with 72% expressing an interest in upcycled products and 63% in pre-owned items.

“In purely decorative terms, clients are looking for uniqueness without breaking the bank, hence the positive combination of upcycled second-hand products”, analyzes one interior designer.

“There’s a real market for these ‘reassuring’, yet updated products”, a decor-shop manager from the South of France says. For an Irish designer and manufacturer, new opportunities are appearing: “Our client companies consider reuse to be beneficial in terms of their social responsibility (…) It’s a positive trend that’s on the rise.”

A WELL-ESTABLISHED OFFER

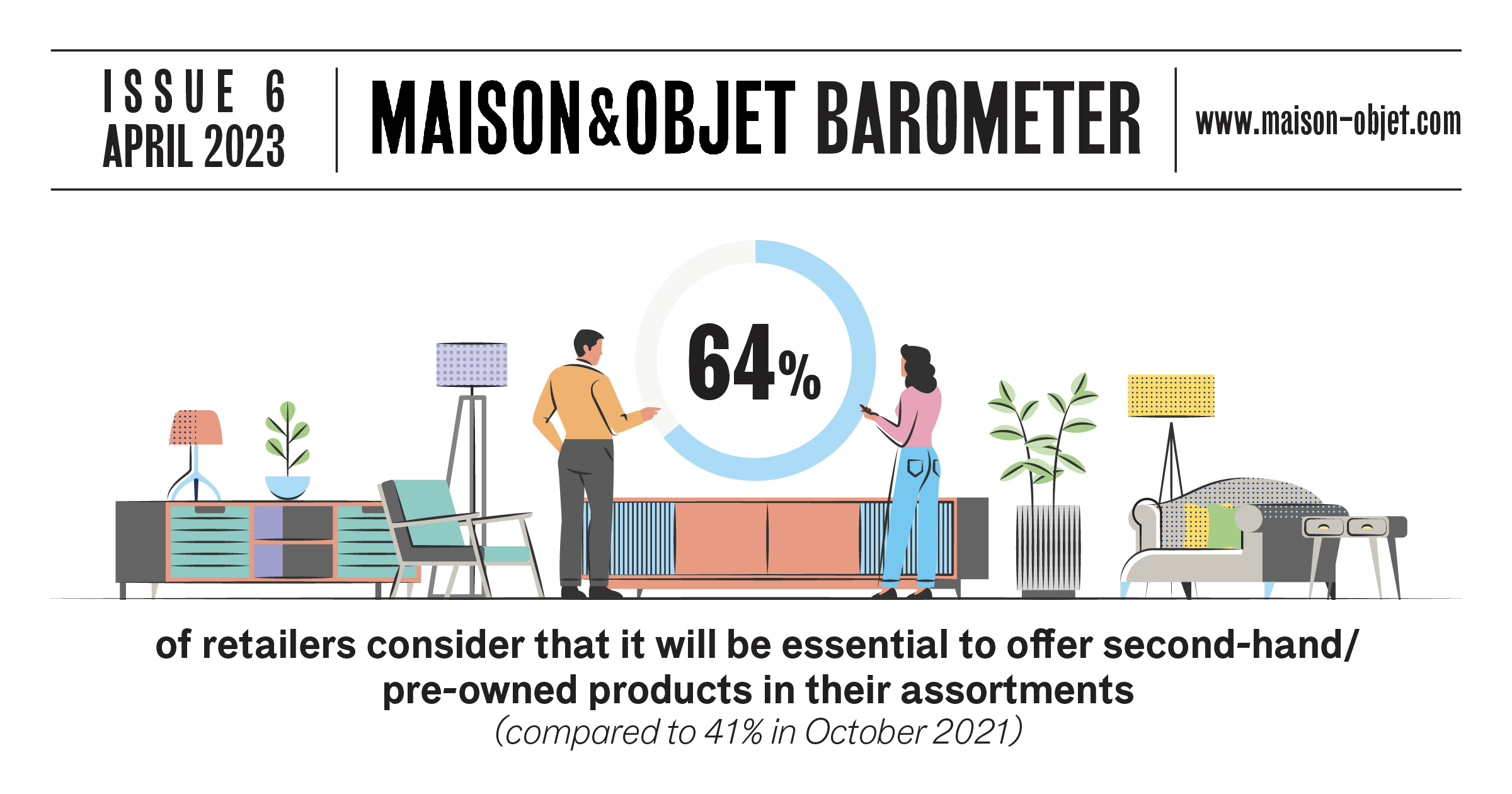

Specifiers (interior designers, decorators, etc.) appear to be the most engaged with and involved in these second-hand products. 95% of them include products using recycled materials in their projects, 89% use upcycled products, and 83% include pre-owned objects and furniture. On the retail side, the expansion of these offerings is clearly underway. 89% of retailers state that they offer products for sale that use recycled materials (43% do so all the time or regularly), and 68% of them sell upcycled products (with 30% of them doing so systematically or regularly). And lastly, 68% of brands say that they sell products made from recycled materials, and half of them (47%), upcycled products. It remains to be seen if manufacturers and retailers of these products will still be able to grow this side of their business because stakeholders have noted a considerable number of obstacles to this.

CLEARLY IDENTIFIED OBSTACLES

For upcycled products, 52% of brands have experienced manufacturing and/or supply issues, mentioning mainly a demand side that remains insufficient, challenges in having a sufficient supply chain, and limited sourcing opportunities. The more limited supply of raw materials, and manufacturing techniques that are more complex, have been mentioned as major obstacles to the growth of a recycled product offer.

It's a problem mentioned by Phydiastone, a new maker of decorative items, furniture, and floor tiles based on reused materials.

“I’m especially thinking of the enormous logistical hurdles that this involves. New fields will need to be created for this to become much simpler: knowing which materials are in stock, where and in what quantities, so we can truly optimize them and envision a new life adapted to its needs”, a product designer points out.

And when the products exist, it’s not easy to find them, another professional emphasizes: “I’m waiting for greater transparency and ease of use from material and furniture suppliers on the origin of their raw materials and their eco-credentials. For me, it’s a fundamental aspect that’s not always easy to highlight because serious research in this area takes a huge amount of time.” Solutions for this are slowly appearing: “At the UFDI**, which I’m part of, a working group is putting together a database of ‘green’ suppliers, and they’re identifying best practices”, the founder of a design and interior decor firm in Rennes (France) informs us.

A SUPPLY AND DEMAND SITUATION THAT REMAINS CHALLENGING

Price remains a major barrier to the implementation of consumers’ eco-friendly desires. “If my clients would only choose sustainability over price, I could work on an exclusively responsible basis”, laments a Swedish interior designer. “(…) One major challenge for us is educating our clients into accepting slightly higher retail prices for recycled or eco-friendly products,” comments a Middle Eastern retailer.

Consumers are not the only ones to come up against the costs of this approach. “Pre-owned and reuse are now areas that interest us greatly, but (…) this results in the same, if not higher prices than those for new items because it requires several resellers and, therefore, several margins before it reaches the client. And this doesn’t even include the time to find the products and the related logistics”, a specifier informs us.

“I founded my company based on local products and upcycling. Nowadays, these are real advantages. Still, the financial equation is anything but simple”, states a fledgling brand.

THE SPECIFIC CASE OF PRE-OWNED PRODUCTS

For brands, second-hand remains a matter for a small section of them (25% of those surveyed).

32% of them see it as a niche market, and though 70% of them find it easy to source products, 26% of them note the logistical limitations of importing these products.

Though pre-owned products may prove to be fertile terrain for specifiers, this is much less the case for retailers. Whereas most architects and interior designers include second-hand products in their projects, less than half of retailers (48%) sell them, and 26% of them only do so occasionally.

For these professional buyers, the main supply sources are, for 64% of them, flea market vendors, antique dealers, and junk shops, and for 60% of them, online platforms. However, though 60% of them consider the pre-owned market to be easily accessible, 45% of them say that finding items is painstaking and a very long process, and 36% lament the limited quantities or volume of products, especially for certain items such as wall and floor coverings, textiles, or outdoor products.

SECOND-HAND: A COMPETITIVE ISSUE

The challenge of this pre-owned market is, thus, for 81% of these buyers, to stand out from the competition. This differentiation happens through a search for one-of-a-kind or iconic pieces, for 59% of them, and such is particularly the case for specifiers (64%). That extra bit of pizzazz that second-hand status can bring to a product is the second factor mentioned. But the first issue highlighted by both specifiers and retailers is the inclusion of second-hand products as part of a more responsible approach overall.

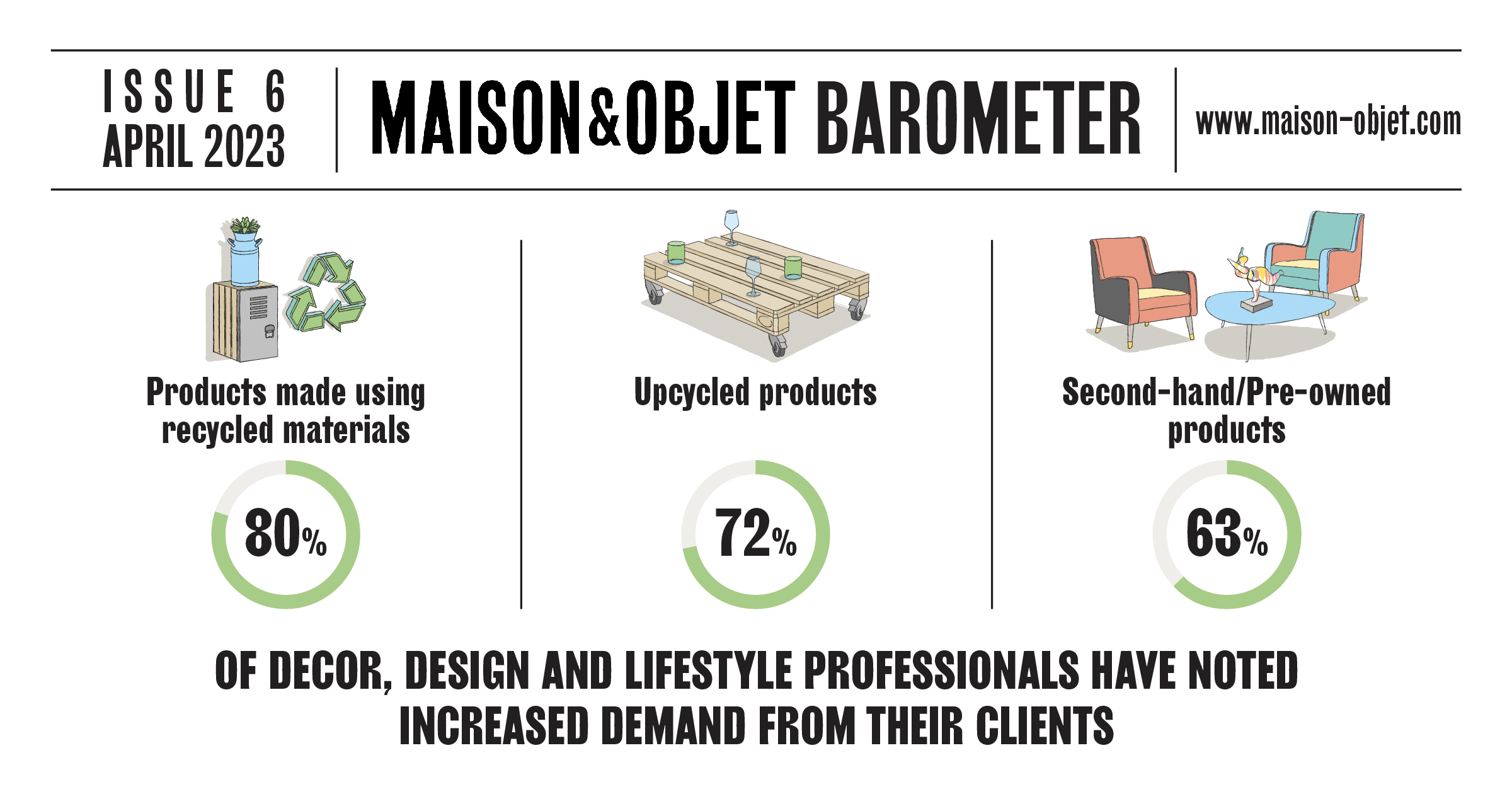

Despite the obstacles they face, industry professionals are increasingly aware that these unique items must be a part of their business: 64% of retailers and 90% of specifiers estimate that in the future, it will be essential to offer second-hand products as part of projects or for retail sale. The figures for those who thought this was essential in 2021 were only 41% and 76%, respectively.

MORE IN-DEPTH INVESTIGATIONS:

RETHINKING THE LIFESPAN OF DESIGN OBJECTS

Maison&Objet Academy helps you understand the market and trends and how to make the right choices for your business.

Duration: 36 minutes

Watch on Maison&Objet Academy